2021/2/7 0:00:00

2021/2/7 0:00:00 2087

2087

The year is approaching, and it is time to organize the results of the year, set goals for the coming year, and look forward to a bright future. On January 13, 2021, the China Automobile Association announced the economic performance of the auto industry in 2020.

According to the data, in December, the production and sales of fuel cell vehicles were completed 264 and 229, down 81.3% and 83.7% year-on-year respectively; for the whole year of 2020, the production and sales of fuel cell vehicles will be 1,199 and 1,177, respectively. According to the "China Automobile Association" "The Economic Operation of the Automobile Industry in December 2019" shows that 2,833 and 2,737 vehicles were completed in 2019, and the production and sales of fuel cells in 2020 will see a sharp decline.

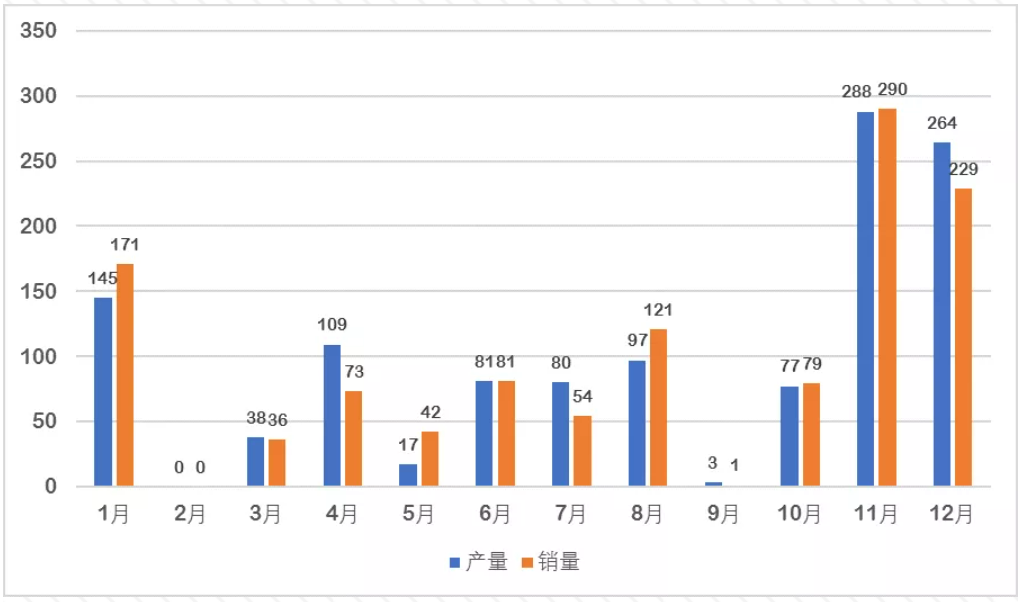

Figure 1 shows the monthly production and sales of fuel cell vehicles from the "Economic Operation of the Automobile Industry" obtained from the official website of the China Association of Automobile Manufacturers. Among them: In the "Economic Operation of the Automobile Industry in July 2020", the production and sales of fuel cell vehicles for the month were not announced, and the cumulative situation from January to July cannot be aligned with the relevant data of the "Economic Operation of the Automobile Industry in August 2020". The related "Economic Operation of the Auto Industry" released later are aligned with the data of the "Economic Operation of the Auto Industry in August 2020". Therefore, the production and sales of the month in July in this statistical chart follow the "January-August Cumulative production and sales"-"January to June cumulative production and sales"-"August month production and sales") calculation.

Monthly production and sales of domestic fuel cell vehicles

From the data shown in Figure 1, it can be found that the production and sales data in February are all 0, which is mainly affected by the epidemic. In March, with the strong leadership of the Party Central Committee, the epidemic in my country was controlled to a certain extent. At the same time, large-scale resumption of work and production gradually began, and the production and sales of fuel cell vehicles gradually recovered, but they have not been able to return to the level of January. According to estimates of the resumption of production from March to August, the annual production and sales volume of 2019 will no longer be achieved in 2020. In September, the sales of fuel cell vehicles fell to single digits again. This change was mainly affected by the imminent announcement of the "reward for subsidy" policy. All companies are in the wait-and-see process, resulting in a decline in production and sales. In October, with the announcement of the "reward for subsidy" policy, the production and sales of fuel cell vehicles were once again boosted, and more than 200 vehicles were produced and sold in November and December. However, from October to December, its monthly production and sales fell by 53.5%, 50.4% (October), 34.4%, 29.1% (November) and 81.3%, 83.7% (December), respectively, that is to say, Even if the policy has clearly supported the method, the production and sales of fuel cell vehicles have not increased significantly because the "urban agglomeration" will ultimately be spent.

The volatility of production and sales in 2020 makes people wonder: The fuel cell vehicle industry is so dependent on policy support, when can it be "weaned and independent" and become Minister Wan Gang from the proposed "three horizontal and three vertical" to support my country's new The last "vertical" of the energy automobile industry.

Taking history as a mirror, observing the development of pure electric vehicles may be able to bring certain enlightenment to the development of my country's fuel cell industry: the development of China's fuel cell vehicles needs to stir the catfish of the sardines, just like the start of Tesla's Shanghai factory. The large-scale emergence of high-quality electric vehicles in China.

The development history of pure electric vehicles

In the previous 20 years, the development history of pure electric vehicles can almost represent the development history of my country's new energy vehicles. Over the past 20 years, my country's new energy vehicles have grown from scratch and ushered in rapid development, roughly going through the following three stages:

Embryonic stage: focus on the demonstration and promotion of new energy vehicles;

The main period of this stage is from 2001 to 2008, from the start of the "three horizontal and three vertical" strategy proposed by Minister Wan Gang to the demonstration operation of the 2008 Beijing Olympic Games. This period of time has become the strategic planning period for my country's new energy automobile industry, and demonstration projects led by the government and enterprises and institutions have proved the feasibility of new energy automobiles.

Rapid growth period: subsidies stimulate the rapid development of the industry;

The main period of this phase is from 2009 to 2016. Starting from the “Ten Cities, Thousand Vehicles” project to large-scale subsidies, the production and sales of new energy vehicles have exploded. At that time, state subsidies were even higher than the manufacturing cost of new energy vehicles. Therefore, even if the car was sold at a discount, the manufacturers were still profitable. Therefore, a large number of fraudulent acts have occurred.

"Cool-down adjustment period": fraudulent supplementary incident & post-subsidy era.

In 2016, the Ministry of Finance exposed a number of car companies' fraudulent activities. In order to prevent fraudulent subsidies, after 2017, new subsidy policies were successively released, the subsidy payment method was strictly enforced, and the subsidy amount was drastically reduced. According to the national plan, the original plan for subsidies for new energy vehicles in my country in 2020 will only retain the part of fuel cell vehicles, while pure electric and hybrid vehicles would have faced the cancellation of subsidies. However, the sudden new crown epidemic has had a serious impact on my country's economy. In order to boost the economy and promote automobile consumption, on April 23, 2020, four ministries including the Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the National Development and Reform Commission issued an announcement on the improvement of new energy vehicles. Notice on the promotion and application of fiscal subsidy policies. The notice pointed out that the comprehensive technological progress, scale effect and other factors will extend the implementation period of the fiscal subsidy policy for the promotion and application of new energy vehicles to the end of 2022.

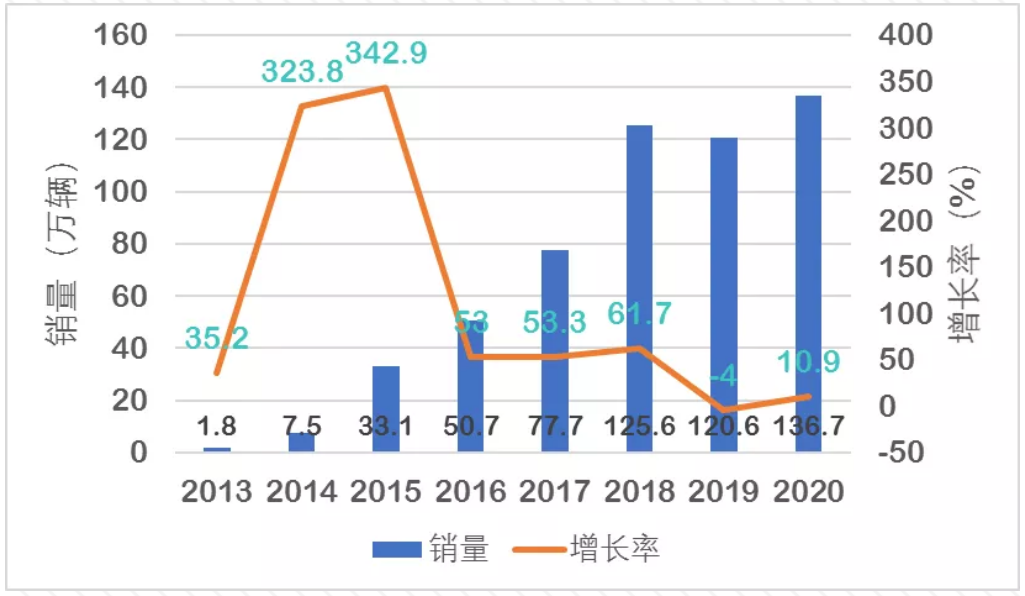

Figure 2 shows the changes in sales of new energy vehicles from 2013 to the present. It can be seen from the figure that before 2016, the sales growth rate of new energy vehicles was extremely high, but after the "fraud compensation incident", the growth rate began to decline. Especially in 2019, due to the policy decline, there has been a decline in sales. It can be seen that in the era of subsidies, my country's new energy vehicles are too comfortable and rely heavily on subsidies. Once subsidies are withdrawn, sales decline will follow.

2013-2020 China's new energy vehicle sales and growth rate

In 2020, the sales of domestic new energy vehicles will grow against the trend. According to the data of "The Economic Operation of the Automobile Industry in December 2020", from January to December, the production and sales of vehicles were 25.225 million and 25.311 million, a year-on-year decrease of 2% and 1.9. %. From January to December, the production and sales of new energy vehicles were 1.366 million and 1.367 million, an increase of 7.5% and 10.9% year-on-year.

From a macro point of view, the contrarian growth of new energy vehicles has a certain relationship with the retention of the subsidy policy. As the policy continues until 2022, it has boosted the confidence of new energy vehicles to a certain extent.

However, from a micro perspective, in December 2020, the top three sales of new energy vehicles were 1. Wuling Hongguang mini ev; 2. Tesla Model 3; 3. Great Wall Euler Black Cat. Among them, Wuling Hongguang mini ev cannot enjoy subsidies due to its cruising range of less than 300km; part of the Tesla Model 3 configuration is too high to enjoy subsidies. Contrary to the impact mechanism of the macro policy, the top two sales of new energy vehicles are actually models that do not enjoy subsidies. This shows that even without subsidies, new energy vehicles can complete the sales task.

So, what is it that will make new energy vehicles grow against the trend in 2020?

In April 2018, the Ministry of Industry and Information Technology issued the "Mid-term and Long-term Development Plan for the Automobile Industry", announcing that it would relax the capital contribution restrictions of foreign automakers when operating production cooperative enterprises in China, and increase the current capital contribution limit of 50% by 2025. Subsequently, Musk hurried to China, intending to open the way for China to build factories. Three months after the meeting, Musk signed a memorandum of cooperation with the Shanghai Municipal Government. At the end of 2018, construction of the factory began. In January 2019, Musk came to China to participate in the groundbreaking ceremony and the factory officially broke ground. On October 17, Tesla's Shanghai plant was approved to start production of Model 3.

The Tesla Gigafactory was selected in Lingang, Shanghai, and it also obtained an unsecured loan of RMB 3.5 billion, with a loan interest rate of 90% of the central bank's annual benchmark interest rate. The Shanghai government abandoned NIO for Tesla, and finally made NIO settle in Hefei. The intention is obvious afterwards: by introducing a benchmark enterprise for electric vehicles, it will quickly seize the high ground of new energy vehicles. At the same time, the issue of whether the alien creature "Tesla" is a shark or a catfish has also triggered discussions in the domestic industry.

After one year, we are very happy to see that Tesla is really a high-quality catfish. With the growth of new energy vehicles against the trend, Wuling Rongguang Mini EV has entered the streets and alleys, and traditional big car companies have launched high-end new energy vehicle brands for private users, opening the curtain of "building new cars". All of this heralds the bright future of my country's new energy vehicles.

Toyota: "Catfish" or "Shark"?

For those who have a little knowledge of fuel cell vehicles, the first car that comes to mind may be Toyota Mirai. Its status in the field of fuel cell is close to Tesla’s Model s: as the first mass-produced fuel cell vehicle, Mirai is indeed compatible with Model S has many similarities. After the release of the second-generation Mirai, as a "large Asian dragon" priced at only 7.1 million yen (approximately 436 million yuan), it really makes people feel good and cheap.

However, after further understanding of my country's fuel cell industry and the direction of national support, there may be doubts about Toyota Mirai becoming this "catfish". From the perspective of my country’s "reward for subsidy" policy planning and the original intention of the "three horizontal and three vertical" policy, fuel cell vehicles in my country are not focused on the development of passenger vehicles, and are compared with lithium-ion batteries. With its high power, long battery life, and fast refilling characteristics, when placed on a passenger car that is often used for commuting to and from get off work, it really has the feeling of "killing a chicken with a sledgehammer". In commercial freight and passenger cars, the characteristics of fuel cells are more suitable.

Therefore, I have always thought that the "catfish that stirs the sardines" will be another company of the same name and the great scientist who invented alternating current, Nikola Tesla: American Star New Car Company. Nikola car.

Nikola Motors and Tesla Motors do have some similarities. Not only do they have the same company name and the same founding country, the prototype cars they develop are also the same as the original Tesla Motors, with a sense of technology. Even Nikola is really well-known to the public because of its "touching porcelain" with Tesla. In 2018, Nikola sued Tesla, claiming that the latter's Semi truck was too similar to its own Nikola One (Figure 3) and violated Its design was patented and it demanded compensation of US$2 billion. Although the incident was not resolved in the end, it successfully put Nikola on the stage and caught the attention of the public.

Nikola One and Tesla Semi truck

On September 8, 2020, the American automobile giant and Nikola Motors reached a strategic cooperation agreement. According to the agreement, the two companies will jointly produce electric pickup trucks and fuel cell commercial trucks to challenge Tesla. In addition, General Motors will acquire 11% of Nikola's shares, which are worth US$2 billion.

However, a start-up with a seemingly bright appearance was exposed on September 16, 2020 to be "fraudulent": the short-selling agency Hindenburg Research published a report on the electric truck manufacturer Nikola (Nikola). According to the report, Nicholas is a "complex scam." Milton has published dozens of false statements about hydrogen fuel cell technology and has established partnerships with major automakers. In fact, they have never owned these hydrogen fuel cell technologies. . Nikola's stock fell sharply. On September 21, Trevor Milton (TrevorMilton) has voluntarily offered to resign as the company's executive chairman, effective immediately. Current board member Stephen Girsky (Stephen Girsky) will replace him as chairman.

At this point, people have clearly realized that although Nikola has become the third-largest automobile company in the United States by market value, in fact the "mastering of core technology" it has been advocating may not have been completed, and its shipments so far are still not as good as domestic ones. Companies such as Yutong and Zhongtong are focusing on fuel cell buses.

So, which car company may become the "catfish" in the field of fuel cell vehicles?

The answer may return to Toyota again, but this time it is not Toyota Mirai, but Toyota's new Class 8 truck based on the Kenworth T680 platform and the fuel cell truck that Toyota may launch in the future represented by this (Figure 4). It is reported that the truck has already entered service in the Port of Los Angeles. Toyota Logistics Services and Southern Counties Express have both received a truck, and the remaining trucks under the contract will also be available in 2021. Delivered one after another.

Toyota's new class 8 truck based on the Kenworth T680 platform

Relatively speaking, Toyota’s new class 8 trucks based on the Kenworth T680 platform appeared late. As early as 2019, there were already many fuel cell trailers of the same type in the Ministry of Industry and Information Technology’s announcement. This means that only the assembly time will come. Said that my country's fuel cell trucks are not too far behind foreign fuel cell buses. However, judging from the parameters of the second-generation Mirai, the fuel cell stack produced by Toyota can meet my country's fuel cell subsidy requirements in terms of performance and durability, and the low price of its vehicle may be lower than the same. The price quoted by domestic manufacturers of fuel cell stack systems, if Toyota enters the market, is likely to be a "shark" rather than a "catfish".

The cost advantage of Toyota's fuel cell stack is likely to make domestic manufacturers helpless. On December 3, 2020, while releasing a new battery stack, Hirui Technology offered the lowest price of 1,199 yuan/kw. But in terms of national fuel cell vehicle sales in 2020, the minimum order quantity of 10,000 units required by its limited "black gold partner" is almost indefinite, so the price may be too aggressive. Based on this radical price, the final price of the fuel cell stack system may be around 3000 yuan/kw, and the total price of a stack of 134kw (calculated based on the Mirai second-generation stack power) may be as high as 402,000 yuan. As mentioned above, the Toyota second-generation Mirai equipped with a 134kw stack is priced at only 7.1 million yen, for a total of 436,000 yuan. If Toyota enters the market directly, domestic manufacturers will have no way of parrying them.

In fact, Toyota has already begun to enter the Chinese fuel cell market. In 2019, Toyota frequently reached cooperation in the field of hydrogen energy in China. The essence of this Products are imported into the Chinese market. In April, Tsinghua University established the "Tsinghua University-Toyota Joint Research Institute" with research directions including hydrogen power and future mobility. The system supplier Yihuatong decided to purchase Toyota's stacks and parts to be equipped on the hydrogen fuel cell bus produced and sold by Beiqi Foton. In July, Toyota copied the same cooperation model to FAW, Suzhou King Long and Shanghai Remodeling. Not satisfied with selling electric stacks and related components, Toyota united China FAW and Guangzhou Automobile Group in September this year to jointly manufacture hydrogen-fueled passenger cars with the latter two.

Fortunately, Zhang Chi, general manager of Qingneng shares, pointed out: Toyota's previous experience is based on its passenger car products. After entering the Chinese market, it will face a commercial vehicle-based application, especially in high-power long-distance applications. In terms of scenarios, domestically-made reactors have already done demonstration operations, and Toyota products are still far from being on the road, and product reliability cannot be guaranteed.

Judging from the current situation, with the technological advancement of domestic fuel cell manufacturers and many manufacturers have actually begun to cooperate with Toyota, the technological gap between my country's fuel cell and Toyota will gradually decrease. It can be seen that Toyota, as an internationally advanced representative, may become a "catfish that eats sardines", accelerating the clustering of my country's fuel cell industry and the development of advantageous enterprises.

Other forms of "catfish"

In addition to the obvious leading foreign companies represented by Toyota, "catfish" may also come from other fields.

Recently, the Ministry of Science and Technology has solicited opinions and suggestions from the public for the 2021 annual project application guidelines for key special projects such as "Hydrogen Energy Technology" and "New Energy Vehicles" in the "14th Five-Year" national key research and development plan. The time for soliciting opinions is February 1, 2021. Until February 21, 2021.

In the topic of "Hydrogen Energy Technology", the directions involving fuel cells are as follows:

1. Research on a new trans-temperature zone perfluorinated proton membrane

2. Development of low-cost and long-life alkaline membrane fuel cell stack

3. High-efficiency and long-life membrane electrode technology for power stations

4. Key technologies of integrated energy supply system integration for residential proton exchange membrane fuel cells

5. Key technologies of tubular solid oxide fuel cell power generation unit and stack

6. High-precision stack assembly and complete batch manufacturing equipment technology

In the topic of "New Energy Vehicles", the directions involving fuel cells include:

7. Development of key technologies for solid oxide fuel cells for vehicles

As we all know, at present, whether it is a foreign manufacturer represented by Toyota or many domestic fuel cell vehicle industry participants, the technology route they choose is low-temperature proton exchange membrane fuel cell (Proton Exchange Membrane Fuel Cell, PEMFC). Its outstanding feature is that it uses a solidified film to effectively isolate hydrogen and oxygen. At the same time, its operating temperature is only 60-80°C, which is consistent with the cooling water temperature control range of traditional fuel vehicles. Therefore, the industry has always believed that PEMFC is the future of FCV.

However, the spirit of the analysis guide shows that the Ministry of Science and Technology may wish to try other possibilities:

The outstanding problem of PEMFC is the need to use precious metal platinum as a catalyst. In order to improve performance, a higher amount of platinum is often required; and based on the characteristics of platinum, carbon monoxide and other common impurity gases in industrial hydrogen may poison platinum. Researchers and the industry chain have also tried to use non-platinum catalysts to replace them. However, under acidic conditions, the durability of transition metal family materials is still unresolved. As a result, there are still no low-cost, high-performance, long-lasting fuel cell products.

In order to solve the problem of PEMFC, people first try to increase the use temperature of PEMFC. From the Bulter-Volmer equation, it can be known that the increase in temperature can effectively increase the reaction rate. However, the proton exchange membrane represented by the Nafion membrane produced by DuPont is not resistant to high temperatures. Although this feature makes PEMFC a certain advantage in cold start and heat dissipation, the final use efficiency still cannot widen the gap with the internal combustion engine. Therefore, changing the performance of the proton exchange membrane to widen its temperature application range, which not only meets the requirements of low-temperature cold start, but also meets the requirements of high performance after startup, will become an important direction in the future, that is, high-temperature proton exchange membrane fuel cells. (High Temperature-Proton Exchange Membrane Fuel Cell, HT-PEMFC). Therefore, the “research on a new type of perfluorinated proton membrane across temperature zones” has become a leader in fuel cell-related directions in the “14th Five-Year Plan” national key research and development plan “Hydrogen Energy Technology”.

In fact, the development of alkaline fuel cell (AFC) is much earlier than the current PEMFC. AFC is the first fuel cell technology development, originally initiated by NASA's space program, on a spacecraft that simultaneously produces electricity and water. However, the AFC transport ion is hydroxide, which is larger in size than hydrogen. Therefore, it is not possible to simply restrict the pore size to prevent hydrogen permeation. For a long time, liquid electrolyte has also been a major pain point of AFC. Therefore, it is necessary to solidify the alkaline electrolyte to become an Alkaline anion exchange membrane fuel cell (AAEMFC). In recent years, as the Zhuang Lin research group of Wuhan University has made breakthroughs in alkaline membrane fuel cells, the key material of alkaline membrane fuel cells, the outstanding advantages of low cost, high durability, and impurity gas resistance of alkaline membrane fuel cells have gradually attracted attention. Therefore, in the "14th Five-Year" national key research and development plan "Hydrogen Energy Technology", "development of low-cost and long-life alkaline membrane fuel cell stacks" has become an important direction after high-temperature fuel cells.

Another spoiler of PEMFC for cars comes from the designated car replacement: solid oxide fuel cell (SOFC). The operating temperature of SOFC is usually between 500 and 1,000°C. At these temperatures, solid oxide fuel cells do not require expensive platinum catalyst materials and are not susceptible to carbon monoxide catalyst poisoning. Traditionally, SOFC has not been regarded as the mainstream direction of vehicle fuel cells due to its high temperature and poor tolerance to vibration. On the contrary, it has always shined in domestic cogeneration and energy storage equipment for power stations. Nowadays, with the advancement of science and technology, the operating temperature of SOFC is gradually decreasing, reaching the level of vehicle availability. Therefore, its high efficiency and low cost are gradually being valued, and it has become the "new energy" in the "14th Five-Year" national key research and development plan. The only fuel cell product in the topic of "Automotive".

On the whole, in the "14th Five-Year" national key research and development plan of the Ministry of Science and Technology, PEMFC for traditional vehicles seems to be kicked out of the frontier technology direction in the game. And HT-PEMFC, AAEMFC and SOFC have become the key support objects of this "14th Five-Year" national key research and development plan. Whether they can become the "catfish" that stirs the fuel cell market for vehicles, let us wait and see.